Making Sense of the Basic Forex Jargons

- Trading Kitten :3

- Apr 9, 2018

- 4 min read

Updated: Mar 14, 2019

Remembering a few is good enough.

As you know, here in Forexpresso, we try to make things less geeky as possible if not fun. But we can’t promise that this time especially to newbies.

This is like learning foreign languages. Words can be alienating and may seem a huge feat to conquer.

BUT with practice, you’ll get used to it.

For those who already have an account, congratulations for taking the necessary step towards a better financial growth and literacy!

For those who haven’t… err, I understand it can be risky and nerve-wracking and scary… You know what, it’s only risky when you do not know what you’re doing. So, start somewhere.

Start small and GET EDUCATED. Get FREE $30 Trading Bonus! <-- Click and Register!

When will you ever take an opportunity of a lifetime? LIFE IS NOW.

It’s IMPORTANT to get an account. Because what we’re about to discuss here are the jargons that are found once you’ve got an account.

So, please… Please Register if you don’t have yet.

All set?

Alright. When you log-in to your account, it would look something like in the photo.

The words you’ll encounter are: Balance, Equity, Free Margin, and Margin Level.

Balance is the easiest as it’s just the cash amount in your account. You must mind it as it’s the money, however, it’s not a trading essential.

The four words are thoroughly explained in helpful sites such as Babypips. I saw one from Luckscout: https://www.luckscout.com/leverage-margin-balance-equity-free-margin-and-margin-level-in-forex-trading/

But since it's our pleasure to make learning these things simple if not fun, we’ll give you that.

In Forex, all you have to care about is winning. And win big. In times you may lose, just lose as little as possible.

Now, in order to win, you will have to participate, don’t you?

You will have to order a position. May it be a buy or sell and by how much/many. Each order has costs (obviously).

Before Luckscout discussed the jargons, it started with introducing Leverage. Yup, it’s not on the list. But it’s a trading essential. “It’s like a special offer featured by the brokers”, it says.

Leverage

Leverage allows you to request bigger orders despite having small account.

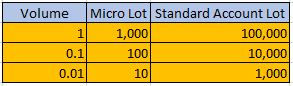

Think more help is going your way. In addition, when you speak of Leverage, you’ll run into Margin especially Lot and Volume. Lot is just the amount of order in bulk. Lot and Volume are similar, just expressed differently. But I'm encouraging you to notice Volume more as it's used upon making orders.

Thus, when you make an order of 1 Lot, you’ll have to input 1 as your Volume. It would mean you’re ordering 100,000 units of the base currency (the first written or the one on the left of a Currency PAIR such as EUR/USD… so in this case, you’re ordering 100,000 units of Euro).

But starting with a small account, you may wonder how it’s possible?

That’s when Leverage comes to your rescue! It’s written like a ratio such as 1:100 and computed as 100,000 units ordered/100 leverage. In this example, it would mean that you only need to spend 1,000 to participate in the trade. The 1,000 here is the Margin, the collateral. The rest is leveraged.

Your leverage depends on what you’ve agreed with your broker. Register with our affiliate broker and you have a choice of up to 1:888.

That, and the FREE $30 Trading Bonus!

The other four words serve to monitor your capacity to participate in the trade. You just have to make sure you have enough of each. If you get curious though unnecessary as they are systematized, this is how they’re computed:

Equity

Equity = Balance + Floating.

Btw, Floating pertains to open positions or ongoing trades. Some of your positions may be in the positive, some negative. This closely reflects how much your account Balance would be like when the trades close. Hopefully it’s leaning towards an increase in value.

Free Margin

Free Margin = Equity – Required Margin.

Shows you how much more collateral you could use to continue trading. But, please do not abuse this. Remember to manage and secure what you have. Use only what’s necessary that’s according to your trading plan.

Margin Level

Margin Level = (Equity/ Margin) x 100.

Similar to Free Margin but expressed in percentage. Please do not abuse this as well. When your trades happen to keep going against you to a point where your account cannot handle the losing positions, you’re gonna get Margin Called. It’s when your broker has to close your trades and you’re left with burnt account. Cliché but risk only a volume that you can afford to lose on each trade.

I won’t delve into these words further. I honestly think there are other more necessary words to mind and integrate to your trading. Such as Position Size. When you know this, you get to maintain the four words above and continue trading.

Why?

Because Position Size allows you to manage your risk.

How?

That’s most likely gonna be our future topic. But to give you a head start, it’s like not putting all eggs in one basket. Keep in touch as this will save you from burning your account Balance.

Takeaways:

Start somewhere. Start small. Get Educated. Keep learning.

Win big. Lose as little as possible.

To win, you must participate in the trade which has costs.

Knowing Volume would help you input a sensible amount to order.

Take advantage of the Leverage

Not all Forex jargons are essential to becoming a better trader. Fibonacci, anyone? The first time I heard it, I honestly thought it was food. I’m not hating. It’s just that it’s making things more complicated for me.

Remember only what’s necessary according to your style. Just focus on what gets the money. Some are already mentioned in the previous articles and our social media contacts.

Review: Support, Resistance, Price Action, Entry, Exit, Target. Then as of this writing, add Volume. These words turn to action. The act of sensibly participating in the trade which, eventually could make you win. Keep it simple that way.

Happy trading everyone!

Sincerely,

@marilesaca || Trading Kitten :3

For comments, discussions, suggestions, and accessing exclusives: Sign-in. It’s Free!

Comments