Target Profit: Reaping Rewards

- Trading Kitten :3

- Apr 24, 2018

- 4 min read

Updated: Mar 14, 2019

More wins, more cash, merrier trader.

Picking up from the previous grim article of risks and negatives of Position Size: How much Risk to Take, it’s about time we celebrate! Here we’re gonna talk about wins, money, money, and more money. There is definitely light at the end of this Forex tunnel.

This is not to say that you guys should forget the previous ones. I’ve mentioned RISK is important! Without it, you won’t reap the rewards. And we’re still gonna mention risks here. But with awesomeness. Before that, I will have to encourage once again those who doesn’t have an account yet to get one. Because what’s the point if you don’t actually win and reap rewards, yeah?

Start your Forex journey NOW.

Get FREE $30 Trading Bonus! <- Click and Register!

Ready?

Let this article be an integration of everything we’ve talked about so far. Hoping that once you look at example photos, it’s more relatable by now.

Remember in Technical Analysis: How to Slice Charts, we have drawn critical zones such as the Support and Resistance. When prices approach these zones, we wait for Price Actions and order accordingly.

In the sample photo, the price approached the Support Zone and showed a Low-Test pin bar. Therefore, the price will likely bounce up and it was a good setup to make a Buy order. You may tweak your Entry and Stop-loss according to your style so long as you have basis and it makes sense.

For now, the usual Entry and Stop-loss for this setup is placing Buy Stop order just above the pin bar while your Stop-loss is just below the pin bar. Why? Because the market rejected the price to go further. Therefore, the price will less likely to revisit that price and avoid hitting your Stop-loss.

Please review Price Action: Busted by Pin Bars and The Buy Low, Sell High Principle.

Notice the distance of your Entry to the Stop-loss has Price Point movement or Pips. And every pip has money equivalent. That is what you’re risking according to the Volume you set. See Calculators.

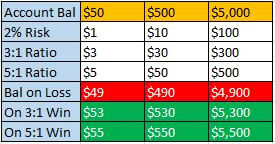

In the example, there is around 90 pips at risk. When we translate that to a $500 account risking 2%, the 90 pips distance is equal to risking $10.

Upon analyzing the chart, you see that you have a big room for an upward bounce from Support going to Resistance. It has over 1:1 Reward-Risk ratio. 5:1 actually before it went the opposite. Not a bad deal, right?

Once the market moved in your favor, you may keep this trade for days. Counting the daily bars, it ran for about 17 days with you on the positive. So, you basically have a lot of time to enjoy the sunshine and come back $50 richer.

Another example on the same chart (this is GbpUsd btw), the price recently approached the Resistance Zone this time. I honestly doubted this (Yes, I’m an emotional trader) because the Pin Bar price action does not have a long tail rejection. But fortunately, my sister got this trade as I’ve proudly announced on our Instagram.

Nonetheless, there was a pin bar on Resistance and signaled a Sell opportunity. Usual entry is a Sell Stop below the pin bar while the Stop-loss is above the bar or the Resistance Zone. Take your pick. Again, this is to make sure your S/L will not get hit.

In addition, about the Entry, set pending orders as much as possible (Buy or Sell Limit and Stop orders) instead of Market Execution. So that you let the price decide where it wants to go as opposed to riding without being more certain of its destination.

You need confirmation. In the example photo, the market finally decided to go down. And your pending Sell Stop is there to catch and ride it. This GbpUsd is still going down. As you can see, it’s now at 3:1. When you translate that again to a $500 risking 2%, your 110 pips equivalent to $10 risk is running now at $30.

This is just one of the endless ways to reap rewards. As you’ve noticed, I’m just been discussing Daily trades. Because this is my style. I’m lazy looking at charts for the entire day. I like going out or doing something else. My sister on the other hand likes the faster shorter timeframes such as 15-minutes and 4-hours. Because she can be impatient yet she’s on her laptop playing computer games. So, she could check charts often.

Well, I was the one who taught my sister. I could teach you the shorter time frames too if that’s your cup of tea. But, you have to have an account first.

Get FREE $30 Trading Bonus! <- Click and Register!

While learning the technicalities are essential, mastering emotions is a must too! I’m a typical human being that can be ruled by emotions. But I’m winning despite this cold and calculating industry.

Perhaps, that’s what I’ll tell you about next time. How to survive with flying colors :D

Happy trading everyone!

Sincerely,

@marilesaca || Trading Kitten :3

For comments, discussions, and accessing exclusives: Sign-in. It’s Free!

Comments